Top 10 Technical Analysis Chart Patterns for Effective Trading

Updated January 19, 2025

In this article

Key Takeaways

Understanding Chart Patterns

Key Continuation Patterns

Essential Reversal Patterns

Show More

Curious about technical analysis chart patterns and how they can enhance your trading strategy? In this article, we’ll cover the top 10 chart patterns, including continuation, reversal, and bilateral patterns, and explain how to use them to forecast market movements.

Key Takeaways

Chart patterns are vital for technical analysis, enabling traders to identify market trends and forecast future price movements based on supply and demand dynamics.

Understanding the three main types of chart patterns—continuation, reversal, and bilateral patterns—enhances a trader’s ability to make informed decisions and capitalize on market movements.

Effective trading using chart patterns requires confirming patterns with trading volume, setting stop losses to manage risk, and choosing realistic profit targets to maximize gains.

Understanding Chart Patterns

Chart patterns are the lifeblood of technical analysis, serving as vital tools for identifying market trends and forecasting future price behavior. Recognizing these patterns helps traders gain a competitive edge in predicting market movements and making informed decisions. Chart patterns represent a collective view of traders’ perceptions and feelings about prices, encapsulating the market’s supply and demand dynamics. These patterns are formations that appear repeatedly on trading charts, indicating potential trading opportunities.

Technical analysts categorize chart patterns into traditional, harmonic, and candlestick forms. Each category offers unique insights and strategies for trading. A price pattern in stock charts represents a recognizable configuration of price movement. This is identified using trendlines and/or curves. Certain chart patterns suggest specific actions for traders, such as buy, sell, or hold, making them indispensable tools for market participants.

Recognizing chart patterns can significantly enhance a trader’s ability to forecast market movements. Market trend analysis is used to predict future price behavior, including trend continuations and reversals. A repeated set of price actions constitutes a chart pattern, and understanding these patterns can provide traders with valuable insights into market trends and potential trading opportunities.

Types of Chart Patterns

Chart patterns can be broadly classified into three main types: continuation patterns, reversal patterns, and bilateral patterns. Continuation patterns suggest that an existing price trend is likely to persist, indicating a temporary pause in the current trend before it resumes. Common chart patterns and trading chart patterns include flags, pennants, triangles, and rectangles.

On the other hand, reversal patterns indicate potential changes in market trends. These patterns signal the end of an existing trend and the beginning of a new one, often in the opposite direction. Examples of reversal patterns include:

The Double Top Pattern, which signifies a bearish reversal

The Head and Shoulders Pattern, which also indicates a bearish reversal

The Cup and Handle pattern, which implies a bullish signal and suggests a potential upward movement

Bilateral patterns, such as symmetrical triangles, can signal either a continuation or a reversal depending on the direction of the breakout. These patterns are characterized by converging trendlines and can provide valuable insights into potential market movements. Understanding these different types of chart patterns is crucial for effective chart pattern analysis and successful trading strategies.

Why Chart Patterns Work

Chart patterns work because they encapsulate the market’s supply and demand dynamics, influencing price movements. By reflecting the forces of supply and demand in the financial markets, chart patterns provide traders with insights into market sentiment and potential price trends. However, it’s essential to approach chart patterns with a data-driven mindset rather than relying solely on emotional decision-making. Traders often misinterpret chart patterns due to emotional biases, leading to misguided trading decisions.

Understanding overall market sentiment is crucial for the success of specific chart patterns. Market sentiment can affect the reliability of chart patterns, making it essential to consider the broader market context when analyzing patterns. Combining chart pattern analysis with market sentiment understanding enhances traders’ ability to identify profitable opportunities and minimize false signals.

Key Continuation Patterns

Continuation patterns are essential tools for traders, indicating that an existing price trend is likely to persist. These patterns represent a collective view of traders’ perceptions and feelings about prices, suggesting a temporary pause before the trend resumes. It is important for traders to assume that the trend will continue until a reversal is confirmed.

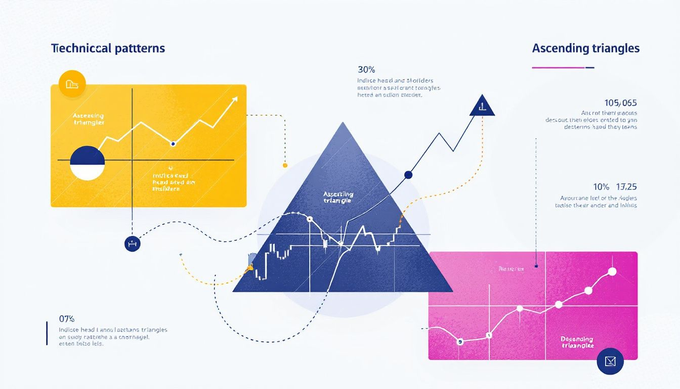

Key continuation patterns include the Bullish Flag Pattern, Pennants, and Ascending Triangles. Each of these patterns provides valuable insights into potential market movements and can help traders identify profitable trading opportunities. By understanding the structure and significance of these patterns, traders can make more informed decisions and improve their trading strategies.

Bullish Flag Pattern

The bullish flag pattern is a powerful continuation pattern that signifies a potential continuation of an upward trend after a strong price movement. The shape of the flag stock chart pattern resembles a sloping rectangle, with parallel support and resistance lines that can slope up or down. These trendlines indicate support and resistance lines that run parallel, forming the structure of the flag pattern.

A bullish flag pattern has three components. It starts with a strong directional move, followed by a slow counter trend, leading to a breakout. This pattern is particularly useful for traders looking to capitalize on an upward trend, as it signals that the market is likely to continue moving in the same direction after a brief consolidation period, indicating a bullish reversal pattern.

Pennants

Pennants are another important continuation pattern, characterized by two converging trendlines, one downward and one upward. These trendlines form a small symmetrical triangle, indicating a short-term consolidation before the trend resumes. During the formation of a pennant, volume typically decreases and then increases at the breakout, confirming the trend’s continuation.

Pennants indicate brief consolidations before the trend resumes, making them valuable for traders looking to enter the market during these consolidation periods. A bearish pennant suggests a downward trend in prices, providing traders with an opportunity to capitalize on the continuation of the bearish trend.

Ascending Triangles

The ascending triangle pattern is characterized by a flat resistance line and a rising support line. This pattern is classified as a continuation pattern, indicating that the existing upward trend is likely to persist. When the price breaks above the resistance line in an ascending triangle, it typically signals the start of a new upward trend.

Breaking above the resistance line in an ascending triangle usually results in a new uptrend, providing traders with a clear signal to enter the market. This pattern is particularly useful for traders looking to capitalize on upward trends and identify potential breakout points.

Essential Reversal Patterns

Reversal patterns are crucial for traders, as they alert them to potential changes in the direction of market trends. These patterns signal the end of an existing trend and the beginning of a new one, often in the opposite direction. Traders look for reversal signals to exit trades or to initiate new ones based on changing market conditions.

Key reversal patterns include the Double Top Pattern, Head and Shoulders Pattern, and Rising Wedge Pattern. Each of these patterns provides valuable insights into potential trend reversals, helping traders make informed decisions and improve their trading strategies, particularly when analyzing a reversal chart pattern.

Double Top Pattern

The double top pattern indicates a bearish reversal. It signals a potential downward trend following an uptrend. Visually, the double top pattern resembles an ‘M’ shape on a chart, formed by two peaks at approximately the same price level. When the price fails to break through the resistance level for the second time, the trend enters a reversal phase, starting a downward trend.

After the trend breaks through the support line following a double top, it typically follows back to the support threshold and continues downward. This pattern is particularly useful for traders looking to identify potential bearish reversals and capitalize on downward trend lines.

Head and Shoulders Pattern

The head and shoulders pattern consists of a large peak flanked by two smaller peaks, indicating a reversal from bullish to bearish. This pattern is classified as a bearish reversal pattern, signaling that sellers are beginning to take control of the market. An uptrend may experience a trend reversal after a head and shoulders top pattern, resulting in a downtrend.

Once the head and shoulders pattern completes, the trend is likely to breakout in a downward motion. This pattern is particularly useful for traders looking to identify potential bearish reversals and capitalize on downward trends.

Rising Wedge Pattern

The rising wedge pattern is recognized as a reversal pattern indicating potential future price declines. A wedge pattern is characterized by tightening price movement between upward-sloping support and resistance lines. The rising wedge pattern typically signals buyer exhaustion and suggests a forthcoming downward trend.

There are two types of wedge patterns: the rising wedge, which indicates potential bearish reversals, and the falling wedge, which suggests bullish movements. This pattern is particularly useful for traders looking to identify potential bearish reversals and capitalize on downward trends.

Bilateral Patterns

Bilateral patterns are unique in that they can indicate either a continuation or a reversal of price movement depending on the breakout direction. Recognizing bilateral patterns is crucial for traders, as it helps in forecasting possible market reversals or continuations. These patterns provide valuable insights into potential market movements and can help traders identify profitable trading opportunities.

Key bilateral patterns include the Symmetrical Triangle and the Descending Triangle. These patterns offer valuable insights into possible market movements. They can assist traders in making more informed decisions.

Symmetrical Triangles

A symmetrical triangle consists of two trend lines, one rising and the other falling, which eventually lead to a breakout. Breakouts from symmetrical triangles often occur in the direction of the preceding trend, making them valuable for traders looking to identify potential breakout points.

If there is no clear trend before a symmetrical triangle forms, it acts as a bilateral pattern, indicating potential for both upward and downward breakouts. This pattern is particularly useful for traders looking to identify potential breakout points and capitalize on market movements.

Descending Triangles

Descending triangles are formed by a horizontal support level and descending resistance levels, indicating potential downward movement. The descending triangle pattern typically signals a bearish downtrend, likely to break out lower through the support level. A descending upper trend line in a descending triangle suggests a likely breakdown, which can be confirmed by falling volume followed by a spike at breakout.

This pattern is particularly useful for traders looking to identify potential bearish pattern breakouts and capitalize on downward trends.

Advanced Chart Patterns Analysis

Advanced chart pattern analysis involves recognizing and interpreting more complex patterns that provide deeper insights into market movements. There are over 75 distinct chart patterns utilized in technical analysis, each offering unique trading opportunities. Effective trading with chart patterns requires a solid strategy that includes recognizing entry and exit points.

Key advanced price patterns include the Cup and Handle and the Rounding Bottom. These patterns provide valuable insights into potential market movements and can help traders make more informed decisions.

Cup and Handle

The cup and handle pattern is a crucial bullish continuation pattern that signals the beginning of an uptrend. This pattern features a rounded bottom with a handle resembling a flag or pennant. The cup forms as the market gradually transitions from a bearish to a bullish sentiment, creating a U-shape, followed by a handle that consolidates before the breakout.

Once the handle is completed, the pattern typically results in a market breakout in a bullish upwards trend. This pattern is particularly useful for traders looking to identify potential bullish movements and capitalize on upward trends.

Rounding Bottom

The rounding bottom pattern, also known as a saucer bottom, signifies a potential shift from a downtrend to an uptrend. This pattern is characterized by a gradual transition in market sentiment from bearish to bullish, often indicating an upcoming upward movement in market prices.

As the rounding bottom forms, the buying sentiment in the market increases, reflecting a shift in market sentiment towards bullishness. This pattern is particularly useful for traders looking to identify potential bullish reversals and capitalize on upward trends.

How to Trade Using Chart Patterns

Trading using chart patterns involves recognizing patterns and making informed decisions based on their implications. Chart pattern analysis aims to predict future price movements based on past patterns, providing traders with insights into stock price trends and trading opportunities.

Successful trading strategies include confirming patterns, setting stop losses, and choosing profit targets. These strategies help manage risk and enhance the effectiveness of trading decisions. These techniques can help traders improve their performance and achieve better outcomes.

Confirming Patterns

Confirming patterns is essential for avoiding false breakout scenarios. Volume serves as a crucial indicator that can validate or invalidate chart patterns. Changes in trading volume can indicate the strength of a price move, and ignoring volume may lead to misinterpretation of chart patterns.

Momentum indicators and aligning candlestick patterns with trend indicators can further confirm potential trades. For example, after spotting a bullish flag pattern, waiting for a couple of green candlesticks can confirm the pattern before trading.

Setting Stop Losses

Setting stop losses is crucial for managing risk effectively in trading. A stop loss ensures that traders don’t lose too much by automatically closing the position if it moves against them. It’s important to set the stop loss at the point where the pattern has failed, ensuring that losses are minimized.

Stop losses help traders protect their capital and maintain discipline. This strategy helps in managing the emotional aspects of trading and ensures that decisions are based on predefined risk parameters.

Choosing Profit Targets

Choosing profit targets involves determining where to place a take profit order and calculating the risk-reward ratio. Traders often determine their profit target by using the height of the chart pattern at its outset. For example, a trader could set a take profit order 50 points above resistance if the bullish flag pattern has a height of 50 points.

The purpose of choosing a profit target is to ensure that traders have a clear exit strategy and can maximize potential gains. Setting realistic profit targets can improve traders’ performance and outcomes.

Tools for Identifying Chart Patterns

Identifying chart patterns requires practice, experience, and the right tools. Traders utilize automated chart pattern recognition software. This helps them identify patterns in various financial instruments. Effective visualization tools and automated software are essential for spotting chart patterns and making informed trading decisions.

These tools can highlight significant technical events and patterns in real time, helping traders identify potential trading opportunities. Advanced tools enhance traders’ ability to recognize and analyze chart patterns.

Pattern Recognition Software

Pattern recognition software often comes with features that highlight significant technical events and patterns in real time. Automated scanners can efficiently identify various chart patterns across different financial assets, providing traders with valuable insights.

Some platforms allow users to customize their scanning parameters for identifying specific chart patterns. This customization enables traders to tailor their analysis to their specific trading strategies and preferences, enhancing their ability to identify profitable trading opportunities.

Mobile Apps for Chart Patterns

Mobile trading applications offer traders the convenience of accessing critical trading information on the go. These apps support both Android and iOS operating systems and are compatible with mobile and tablet devices.

Mobile applications for chart pattern analysis provide features like customizable alerts based on pattern recognition. These apps keep traders informed about market movements, enabling timely decisions regardless of location.

Common Mistakes in Chart Pattern Trading

One common mistake traders make is failing to confirm patterns with volume, leading to misguided decisions. Confirmation of a pattern can be reinforced by observing trading volume spikes at breakout points. Volume often declines and increases on breakout, reflecting the strength or weakness of price movements.

Additionally, traders often enter trades solely based on pattern recognition, ignoring other critical factors like volume and market context. Understanding the broader market context is crucial for making informed trading decisions and avoiding false signals.

Integrating market conditions with technical patterns helps develop more effective trading strategies.

Overlooking Volume Changes

Volume is a critical indicator in confirming chart patterns, reflecting the strength or weakness of price movements. As the head and shoulders pattern develops, volume may decline before springing back significantly once the price breaks above or below the trendline.

When trading based on chart patterns, observing volume changes can alert traders to potential false signals. Understanding the relationship between volume and price action is essential to enhancing trading accuracy and minimizing risks.

Ignoring Market Context

Ignoring market context is a frequent error traders make, leading to increased risk of false signals and poor trading outcomes. Understanding the broader market context is crucial for making informed trading decisions.

Traders should integrate market conditions with technical patterns for more effective trading strategies. By considering market trends and other external factors, traders can improve their ability to identify profitable trading opportunities and minimize risks.

Summary

In conclusion, mastering the top 10 technical analysis chart patterns can significantly enhance your trading strategy and improve your ability to predict market movements. From continuation patterns that signal the persistence of trends to reversal patterns that indicate potential market shifts, each pattern provides valuable insights into potential trading opportunities.

By combining chart pattern analysis with an understanding of market sentiment and using advanced tools for pattern recognition, traders can develop more effective trading strategies and achieve better outcomes. Remember to confirm patterns with volume, set appropriate stop losses, and choose realistic profit targets to manage risk effectively. Armed with this knowledge, you are now better equipped to navigate the financial markets and make smarter, more profitable trading decisions.

Frequently Asked Questions

What is the best chart for technical analysis?

The best chart for technical analysis is the candlestick chart, as it effectively represents price actions and is widely preferred by traders for its informative visual structure.

What is the 1/2/3 pattern in trading?

The 1/2/3 pattern in trading is characterized by three significant price points, where point 2 serves as a correction, with point 3 being lower than point 1 in a bullish market and higher in a bearish market. This pattern helps traders identify potential market reversals.

What are chart patterns in technical analysis?

Chart patterns in technical analysis are distinct formations on price charts that indicate potential future price movements based on historical data. They serve as a crucial tool for traders to identify possible breakouts and reversals in the market.

What are chart patterns?

Chart patterns are repetitive formations on trading charts that suggest potential trading opportunities related to market trends and price movements. They serve as essential indicators for traders in making informed decisions.

How do continuation patterns differ from reversal patterns?

Continuation patterns indicate that a current price trend will likely continue, whereas reversal patterns signal potential changes in market trends. Understanding these distinctions can help in making informed trading decisions.